Electronic Billing Solutions for ZATCA

Keep your business compliant all the time

Phase One (Generation Phase)

- Generation of Tax Invoices and Simplified e-invoices

- Storage of e-invoices

- Approved invoice templates

- QR Code Integration

- Confirmation of the QR code with the Zatca mobile app

- Send Mail to Buyer automatically from the application

- Control your invoices payments and outstanding summary

Phase Two (Integration Phase)

- Integration with Fatoora portal

- Onboard devices & generate OTP

- E-invoice generation and hashing XML – Tax & Simplified invoices

- Generate Digital signature

- Integrate the Zatca QR code

- Generate PDF/A3 with integrated XML

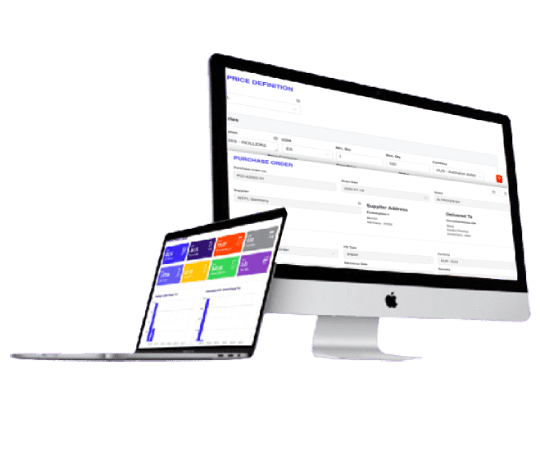

- Dashboards in the application

- Track acceptance/rejections

- Take corrective actions with simple clicks

- Send Mail to Buyer automatically the approved e-invoices

Cloud E-Invoicing Solution

Easy to use and flexible E-invoicing application for Phase 1 & Phase 2

Your Needs

- Enabled your business with E-invoices

- Be compliant to ZATCA norms

- Cost effective solution

- Scalable Solution

- Tracking of invoices and reports

- Secured solutions

Our Solutions

- Easy and simple E-invoicing Solution

- ZATCA approved solution provider

- Phase 1 and Phase 2 compliant solution

- Scale up in future for sales, purchase, HR etc with zero costs

- Dashboard for your daily tasks

- Application in Saudi Arabia Cloud

Create invoices free and validate our Solution and get comfortable

100%

ZATCA Compliance

Get digital in

5 minutes

E-invoice in just

3 Clicks

30 days

Free trial

Our E-invoicing Solutions makes your Business life easy & professional

Zero Risk

Application validates your data before sending to ZATCA. It ensures 100% compliance all time and on time

Easy to Use

Simple User interfaces requires Zero IT knowledge. Mobile friendly. Stay connected anywhere anytime

Zero Infra Costs

Cloud based application needs zero installation efforts. Simply subscribe and start using in less than 5 minutes

Pay for usage

No advances or credit cards are taken. Pay after use and unsubscribe anytime with zero conditions

Suitable for all

Application can be used from single owner company to enterprises. Suitable for only Phase 2 integration as well

Cloud or Onpremises

Application is hosted in Saudi Arabia Cloud and also available for private server installations. Plug and Play model.

Our Electronic invoices assist you to grow your Business

Connect your Team

Add users and give access

Control the access rights

Inform Customers

Simple User interfaces requires Zero IT knowledge. Mobile friendly. Stay connected anywhere anytime

Easy Data upload

Upload your customers, products from excel

Unlimited uploads

10+ invoice templates

10+ ZATCA Approved templates

Customize as per your needs

Easy invoices

Create invoices in 3 Clicks

Print, download or send by mail

Zatca approvals

Immediate compliance checks

Send to ZATCA with one Click

Error corrections

Correct your invoice errors

Resend to ZATCA for approval

Dashboard

Monitor your company performance

Check all key parameters in one place

Extend to full ERP

Upgrade anytime to full ERP

Sales, Purchase, Accounting and HRMS

Do you know that it only takes 30 minutes to get digitalized?

QR code invoices in any device or browsers

Customers

Users

Documents Per Year

Support Team

Our Clients

Frequently Asked Questions

E-invoices are digital invoices following certain standards and norms. They are generated from an application in a consistent format and with mandatory information needed for Taxation purposes. Some of the key information that a tax e-invoice should contain are Buyer name, Buyer address, Buyer CR no, buyer VAT no, Seller name, Seller address, Seller CR no, Seller VAT no, Material information, date of supply, price, amount, VAT%, Vat amount at line level and VAT amount at invoice level, QR code compliant with the tax authorities. It is important that all these fields are consistent without errors and with running number of the invoices. Any errors will lead to penalties. It is possible to do an e-invoice manually but it could definitely have manual errors which poses a huge risk for an organisation in terms of penalties. The digital invoices are not just pdfs but they need also transmit data in an encrypted way to the Tax authorities. These kinds of communications happen in XML or Json format over a secured protocol which are known as “structured data transmission”. Manual encryption and transmission is possible but comes with lots of efforts and risks.

Following are the documents that are covered under e-invoicing

Tax invoices – These are quite detailed invoices and mostly suitable for B2B customer invoices

Simplified tax invoices – These are simple invoices with basic information and mostly suitable for B2C customer invoices like ecommerce or POS.

Credit invoices – These are similar to detailed invoices format and suitable for B2B and B2C

Debit invoices – They too follow the same standards like Tax invoices

ZAKAT implemented digital invoices in Saudi Arabia from Dec.2021 for Tax Management and control.

Phase 1 (from Dec.2021) objective is to enable all Businesses in Saudi Arabia to send digital invoices as per the ZAKAT norms with the QR code that is embedded in Base64 code format

Phase 2 (from 01.Jan.2023) objectives are

- Tax payer should register in ZAKAT portal

- On Registration, digital certificate will be created by ZAKAT

- Solution provider like CloudPital will send the invoices to ZAKAT but before sending, using the company key, the digital signatures will be done on the invoices and transmitted

- Response will be given by ZAKAT and the invoices are approved

ZAKAT has released the SDK documentations to validate the XML generations and QR codes. ZAKAT is yet to release the documentation for the integration phase with digital signature and transmission.

Phase 1 (from Dec.2021) objective is to enable all Businesses in Saudi Arabia to send digital invoices as per the ZAKAT norms with the QR code that is embedded in Base64 code format

Phase 2 (from Dec.2022) objective is to transmit all invoices automatically to ZAKAT through web services for which ZAKAT already published the file formats and protocol. All companies should create digital e-invoices and transmit the same to ZAKAT. ZAKAT will then approve these invoices and return with digital signature.

CloudPital is providing e-invoicing solutions for various segments of Business from Micro to Enterprises. For Micro business with one user, CloudPital provides free e-invoice. No subscription needed. Simply click the link, create the invoice and send by mail. Invoices will be available for 2 years for reference anytime. For Small medium business with multiple users, CloudPital offers a cloud based e-invoicing solution. In just 3 clicks, a company can subscribe to the platform and in less than 30min, start e-invoicing in full-fledged. CloudPital wizard guides the upload of past or masters from an Excel into the application. For Enterprise business, already using an ERP solution, CloudPital offers cloud based or on-premises e-invoicing solution. The application integrates with any ERP/Solutions like SAP, Quickbooks, Zoho and Magento. In less than 8 hours, we can integrate your existing business solutions with CloudPital for e-invoicing.